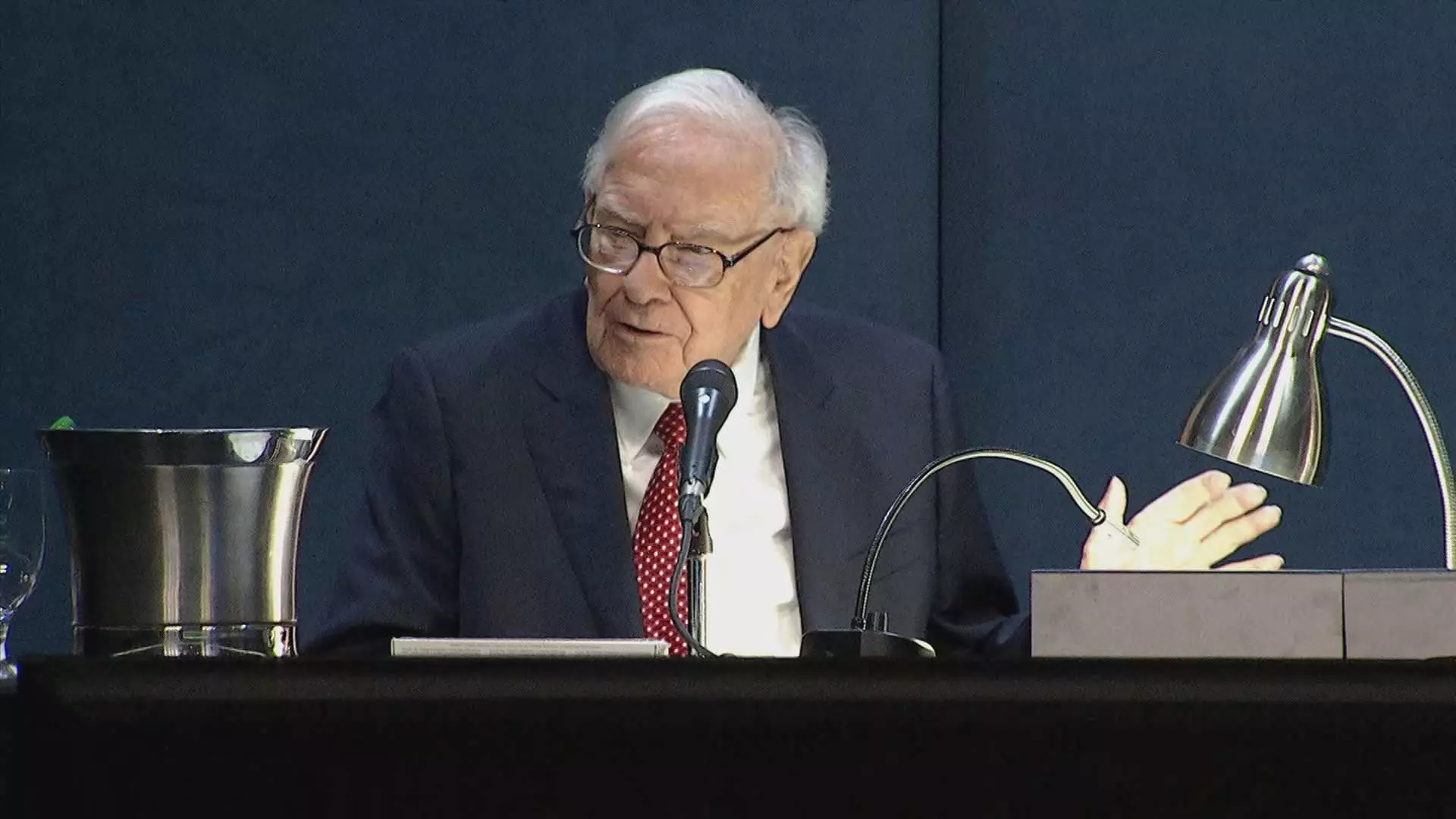

Warren Buffett, known as the “Oracle of Omaha,” made headlines recently as it was revealed that he now owns the exact same number of shares of Apple as he does of Coca-Cola. This interesting observation came to light after a regulatory filing showed that Berkshire Hathaway’s equity holdings at the end of the second quarter consisted of an identical 400 million share count in both Apple and Coca-Cola. Many followers of Buffett are speculating whether this is simply a coincidence or part of a master plan by the legendary investor.

Buffett’s history with Coca-Cola dates back to 1988 when he first bought 14,172,500 shares of the company. Over the years, he increased his stake to 100 million shares by 1994 and has since kept his Coca-Cola holdings steady at this round number. Due to stock splits in 2006 and 2012, Berkshire’s Coca-Cola holding eventually reached 400 million shares, mirroring the current number of Apple shares owned by Buffett. This steadfastness in his Coca-Cola holdings has led some to believe that Buffett views both Coca-Cola and Apple as long-term, “permanent” holdings.

Despite being known for his value investing principles, Buffett’s investment in tech giant Apple may seem at odds with his traditional strategy. However, Buffett has viewed Apple not as a technology company, but rather as a consumer products company similar to Coca-Cola. He has praised Apple for its loyal customer base and even stated that it is the second-most important business in Berkshire’s portfolio after its cluster of insurers. This unique perspective on Apple may have contributed to his decision to maintain a significant stake in the company, despite recent reductions.

In a surprising move, Berkshire Hathaway sold more than 49% of its stake in Apple during the second quarter, reducing Apple’s weighting in Berkshire’s portfolio. This decision raised questions among investors and analysts, with many speculating that it was part of a larger portfolio management strategy rather than a reflection of Apple’s future prospects. Despite this significant reduction, Buffett’s holdings in Apple have settled at a round number of 400 million shares, signaling a potential long-term commitment to the company.

While some argue that the identical share counts in Apple and Coca-Cola may simply be a pure coincidence, others believe that Buffett’s meticulous nature and long-term investment approach suggest a strategic move. Buffett himself has compared the two companies and noted that the holding period for both is unlimited, emphasizing his commitment to long-term investments. Whether this alignment in share counts is intentional or accidental, it has sparked widespread interest and speculation among investors and Buffett followers alike.

Warren Buffett’s equal share counts in Apple and Coca-Cola have raised intriguing questions about his investment strategy and long-term outlook on both companies. Whether this coincidence is a reflection of Buffett’s meticulous planning or simply a random occurrence remains to be seen. As one of the most renowned investors in the world, Buffett’s actions and decisions continue to captivate the financial world and provide valuable insights for investors of all levels.