Warren Buffett’s recent decision to further reduce Berkshire Hathaway’s stake in Apple Inc. marks a significant shift for the legendary investor, who has long been regarded as a champion of value investing. As reported in the third-quarter earnings statement, Berkshire now holds approximately $69.9 billion worth of Apple shares, a staggering reduction of about 67.2% since this time last year. This trend of diminishing equity—evident for four consecutive quarters—raises pertinent questions about Buffett’s evolving strategy and motivations behind this calculated retreat.

While the exact reasoning behind Buffett’s sustained selling spree remains somewhat opaque, several factors have been posited by analysts and financial observers. The high valuation of Apple shares could indeed be a compelling reason for Buffett to reduce exposure to the tech giant. The growth trajectory of Apple, while impressive, has led to concerns over potential market corrections, making heavy concentration in a single holding a risky proposition. Analysts suggest that diversification is a protective measure allowing Berkshire to mitigate the adverse impacts of market volatility.

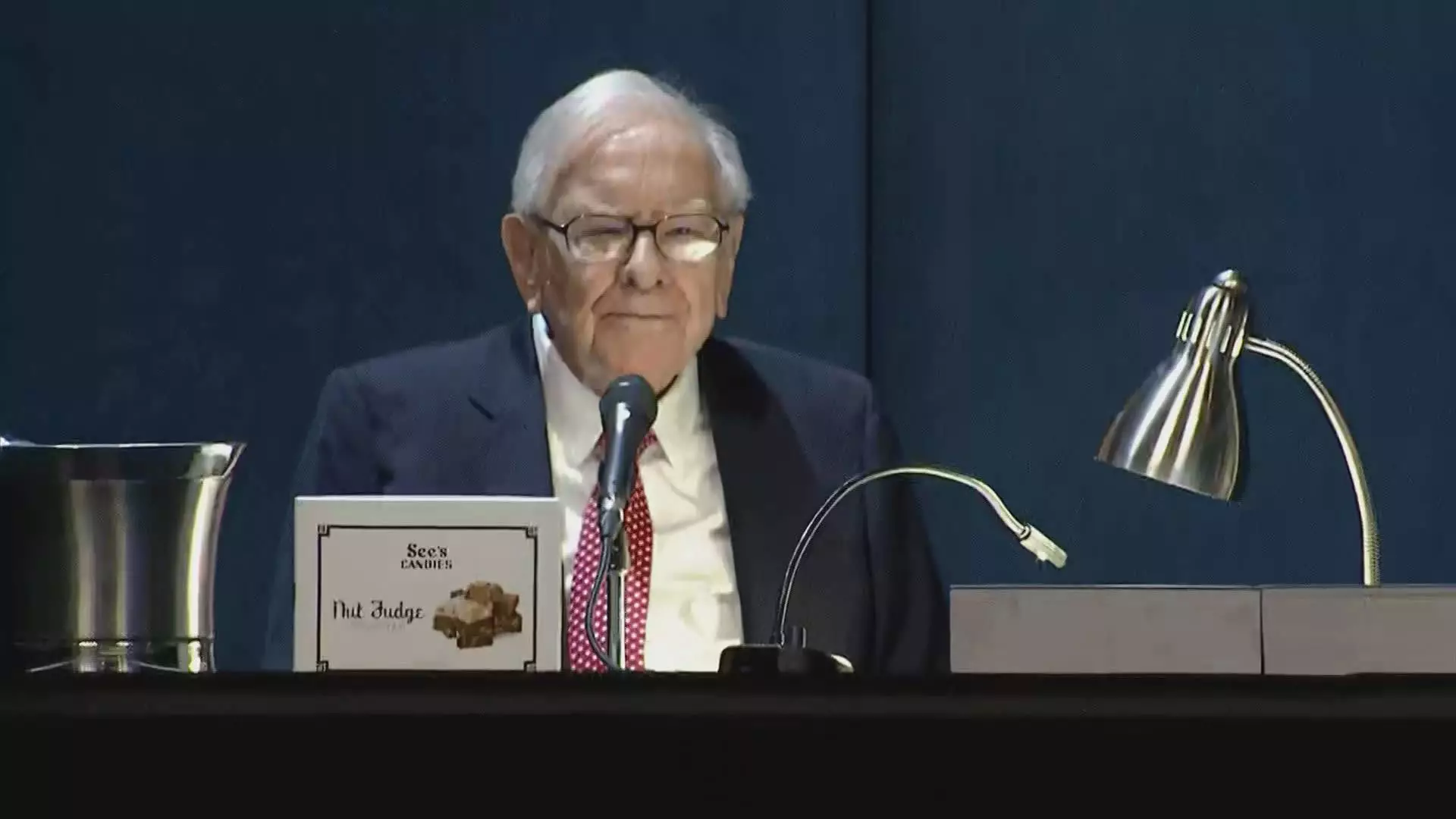

Furthermore, Buffett mentioned potential impending changes to capital gains taxes during the May annual meeting, hinting that his sales could be precautionary maneuvers aimed at minimizing future tax liabilities. While tax considerations might have spurred the initial sell-off, the sheer scale of the shares being sold suggests there could be deeper strategic shifts in motion. The once-cohesive relationship between Berkshire and Apple seems to be undergoing a recalibration in response to both macroeconomic and microeconomic pressures.

Buffett’s transition into technology investments, culminating in his substantial Apple holding, stands in stark contrast to his historical stance on the sector. Previously, he had notably avoided technology companies, deeming them outside his “circle of competence.” This shift captivated many, as Buffett redefined his investment strategy by immersing himself in a company that epitomized technological innovation and customer loyalty. The iPhone’s market penetration and Apple’s cultivating of a dedicated consumer base played pivotal roles in Buffett’s initial affection for the tech giant.

However, with the recent downsizing, one must wonder whether the Oracle of Omaha is re-evaluating his footing within the tech landscape. Apple’s evolution into Berkshire’s most significant investment exemplified a risk that has not materialized the way Buffett may have envisioned, leading to a potential rethinking of the company’s role in his diversified portfolio.

Compounding the strategic reworking of Berkshire’s equity portfolio, the company’s cash reserves reached an unprecedented $325.2 billion in the third quarter. This remarkable sum underscores the conglomerate’s position as a financial powerhouse, yet it also raises questions about potential investment opportunities that may be neglected in favor of liquidity. With cash levels this high, the absence of share buybacks during this period offers a window into Buffett’s mindset—potentially waiting for more favorable conditions to deploy capital.

As Apple shares outperformed the broader S&P 500 with a 16% increase this year, lingering doubts surrounding the stock’s long-term value may resonate with Buffett’s apprehensive stance. Ultimately, the ongoing evolution of Berkshire Hathaway’s investment strategy holds essential insights for the future of value investing and the broader market landscape. As the world watches Buffett’s every move, it is evident that the man himself remains a towering figure, navigating a landscape that continues to challenge even the most seasoned investors.