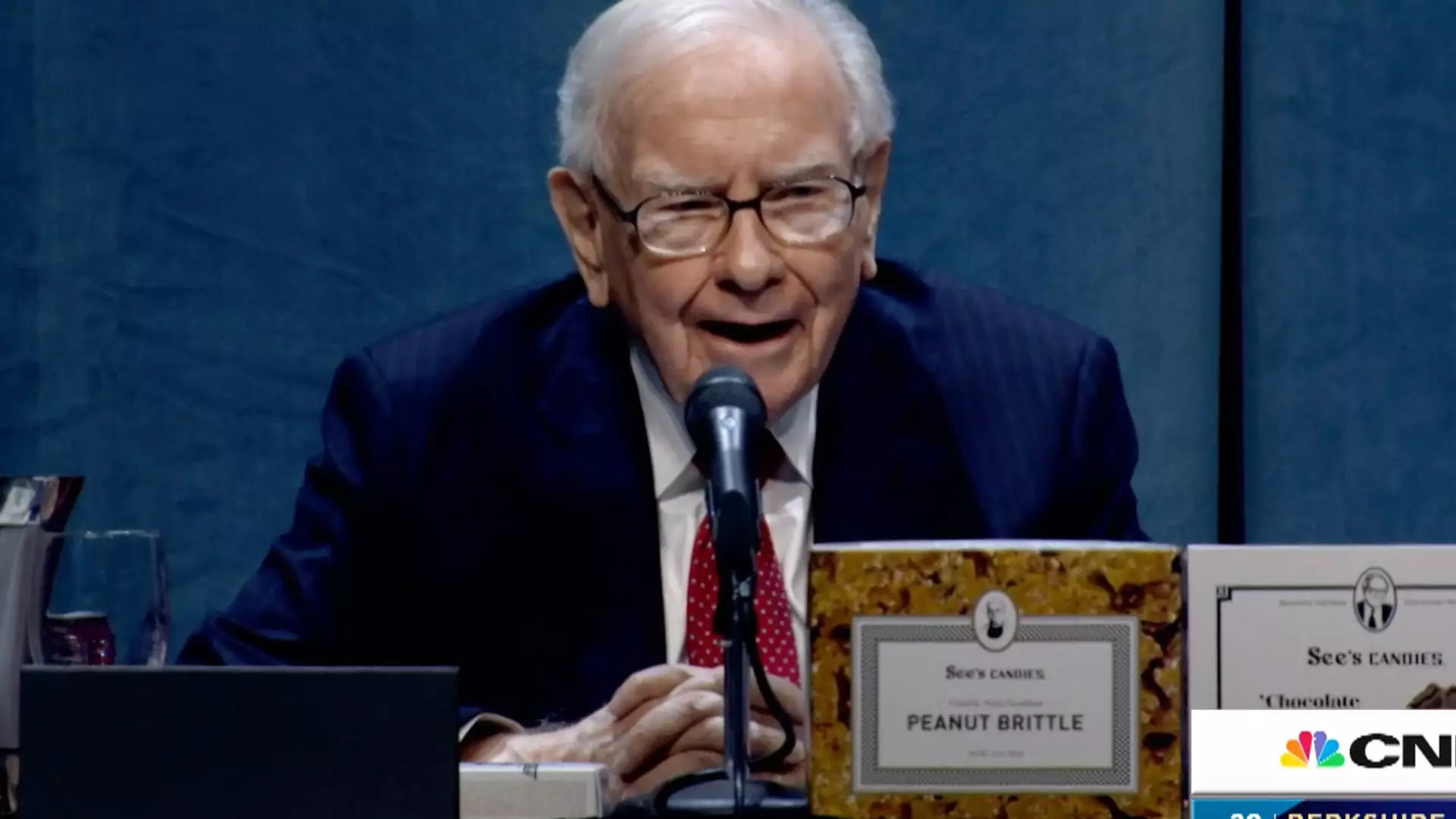

Warren Buffett, the revered investment maestro and CEO of Berkshire Hathaway, recently expressed his thoughts on President Donald Trump’s tariffs, drawing attention to the broader implications of such economic policies. Buffett, known for his insightful analysis, suggested that tariffs could act as a double-edged sword, exacerbating inflation and ultimately placing a financial burden on consumers. His perspective, likening tariffs to an act of war, underscores the serious repercussions that trade policies can have on the economy at large. His vivid analogy—that “the Tooth Fairy doesn’t pay ’em”—effectively highlights the fact that tariffs are essentially a hidden tax levied on goods, leaving consumers to shoulder the financial responsibility.

Buffett’s worries are not unfounded. Historically, tariffs are intended to protect domestic industries by making imported goods more expensive. However, this can lead to a cascade of economic consequences, including inflation, which disproportionately affects the average consumer. As prices rise due to higher import costs, consumers may find themselves in a precarious financial position. This situation becomes particularly concerning when viewed through the lens of a post-pandemic economy striving for stability. Buffett’s emphasis on asking “And then what?” serves as a reminder of the subsequent questions that arise from economic policy decisions. The pursuit of short-term benefits by imposing tariffs can often lead to long-term pain for the economy.

In his recent interview, Buffett chose to sidestep a direct assessment of the current economic landscape. His reluctance to provide insights speaks volumes; it may indicate a cautionary stance as he navigates a market characterized by volatility and uncertainty. Faced with a backdrop of rising inflation, fluctuating stock valuations, and impending tariffs, his defensive maneuvers suggest a recognition of the economic storm brewing on the horizon. Market participants often view Buffett’s moves as precursors to market trends; his current stock sell-off and accumulation of cash signal a more reserved outlook in contrast to the prevailing optimism.

Despite his caution, it’s essential to recognize the adaptability of the market and the economy. Buffett’s legacy is built upon a foundation of resilience and strategic foresight. His considerations about tariffs serve as a pivotal reminder for investors to remain vigilant. As the S&P 500 reflects only a marginal increase of 1% this year amid rising travel restrictions, fluctuating consumer confidence, and geopolitical tensions, investors are called upon to analyze the market dynamics with a discerning eye.

Buffett’s commentary not only sheds light on the perils of tariffs but also serves as a clarion call for prudent investment strategies. Given the interconnectedness of global economies, understanding the far-reaching consequences of trade policies is crucial for effective financial decision-making. As investors navigate this uncertain terrain, Buffett’s insights remain an invaluable guide in the complex world of economic shifts.