As digital transactions become an intrinsic part of our daily lives, the prevalence of online scams has surged, particularly on social media platforms. In response, financial institutions and fintech companies are increasingly vocal about the need for these platforms to take greater responsibility for the fraud occurring within their ecosystems. Recent criticism from British fintech firm Revolut towards Meta, the parent company of Facebook, highlights a significant concern: that these tech giants are doing too little to protect their users from financial scams.

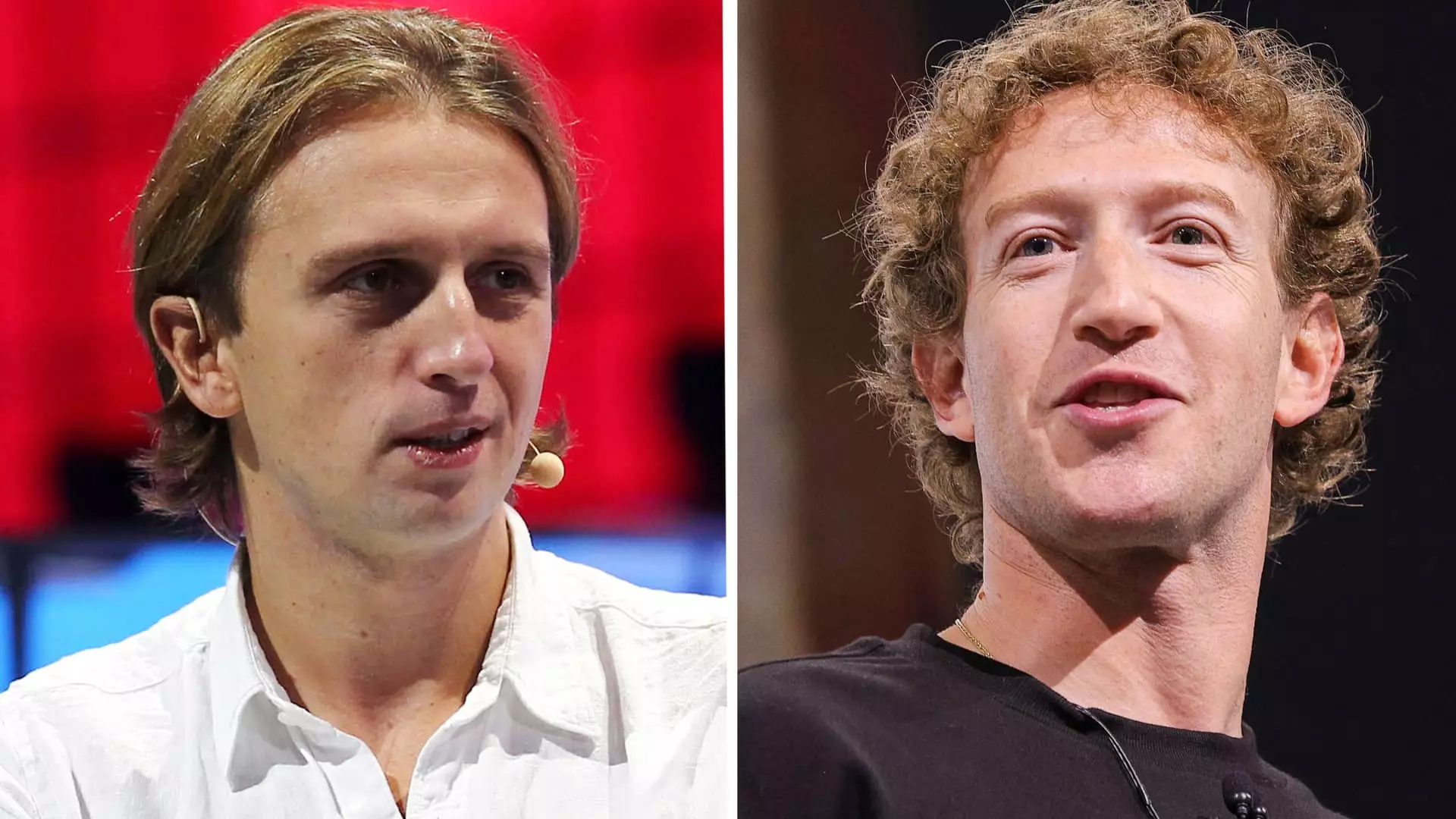

On October 5, 2023, Revolut publicly criticized Meta’s new partnership with U.K. banks NatWest and Metro Bank. While this collaboration is centered around a data-sharing initiative aimed at curbing fraudulent activities, Revolut deemed these measures as inadequate. Woody Malouf, Revolut’s head of financial crime, expressed that the measures taken by Meta were not substantial enough to address the scale of fraud impacting users globally. Malouf’s statement revealed a growing frustration in the financial industry: scammers often exploit social media platforms, yet those platforms bear little accountability for the financial repercussions faced by victims.

Malouf underscored a pivotal issue: without the responsibility to compensate victims, social media companies have little incentive to enhance their fraud detection strategies. The remarks reflect a broader industry sentiment that platforms like Meta should not only participate in discussions about fraud prevention but must also take actionable steps that put the onus of responsibility on them. Revolut’s advocacy for direct compensation to scam victims positions the firm as a champion for user rights within an increasingly perilous digital landscape.

Upcoming reforms in the U.K. payment industry are set to bolster consumer protection, mandating that banks and payment processors provide victims of authorized push payment (APP) fraud with compensation up to £85,000 (approximately $111,000). This shift represents a significant move towards protecting consumers, yet critics point out that this is a less ambitious approach compared to earlier recommendations of a £415,000 cap. While the regulatory environment is beginning to change, calls for social media platforms to abide by similar standards grow louder.

Revolut’s stance emphasizes a crucial point: tackling financial fraud requires a collective approach involving tech companies, financial institutions, and regulatory bodies. As scams continue to evolve, so too must the strategies to combat them. The challenge extends beyond just adopting data-sharing measures; it involves fostering a landscape of accountability. The dialogue sparked by Revolut encourages scrutiny of how effectively social media companies are safeguarding users and raises questions about their role in the ongoing battle against fraud.

As fraudsters become increasingly sophisticated, the reluctance of social media platforms to share in the financial responsibility for scams complicates the fight against online fraud. Revolut’s bold statements serve not only as a critique of Meta’s current strategies but also as a rallying cry for more significant changes in the industry. For meaningful progress to occur, it’s vital for social media giants to step up, embrace accountability, and implement tangible solutions that protect users from the pervasive threat of fraud.