As the year-end approaches, Asian equity markets experienced a modest uptick amidst thin holiday trading. This slight rise continues a trend established earlier in the week where most indices saw gains without any significant data or news to disrupt their momentum. The current market activity is characterized by reduced trading volumes, typically observed during holiday periods, a scenario that prompts investors to focus on major economic indicators such as the outlook for interest rates set by the Federal Reserve (Fed).

Markets are notably quiet, and in some regions like Hong Kong, Australia, and New Zealand, trading activity was halted due to public holidays. This lull in trading must be viewed through the lens of the broader economic context, where upcoming monetary policy decisions from the Fed loom large over investor sentiment and behavioral patterns in capital markets.

After dovish signals from Fed Chair Jerome Powell regarding a less aggressive stance on interest rate cuts for 2025, traders have recalibrated their expectations, now anticipating only about 35 basis points of easing. As a result, U.S. Treasury yields have shown an upward trajectory, with the benchmark 10-year yield recently steadying at around 4.5967%. This marks a significant milestone as it surpassed the 4.6% threshold for the first time since May, indicating heightened investor confidence potentially spurred by economic growth indicators.

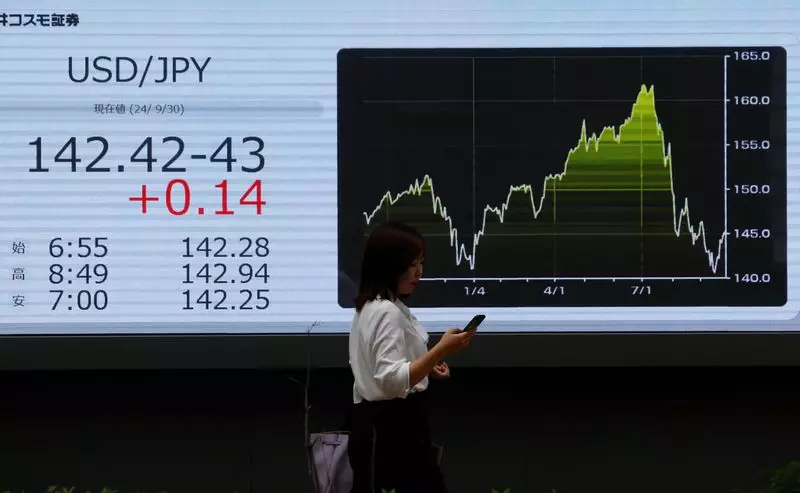

The rise in Treasury yields has also strengthened the dollar, raising it to a two-year high against a basket of currencies. The Japanese yen and other major currencies have responded poorly, with the dollar trading at 108.15. The Australian and New Zealand dollars, in particular, struggled under the weight of the advancing greenback, reflecting broader trends in global currency markets influenced by the Fed’s policies.

Tom Porcelli, a notable economist at PGIM Fixed Income, speculates that the Fed may refrain from any significant policy changes in its January meeting, favoring patience until more substantial economic data comes to light. This caution suggests that market players will need to stay attuned to economic reports, which will significantly influence trading and investment strategies in the early days of 2025.

The sustained strength of the dollar and the subsequent impact on commodity prices reflect the interconnected nature of these financial instruments. As the dollar surges, commodities like gold struggle to maintain their value, a trend observed with spot gold prices fluctuating at around $2,626.36 an ounce. This dynamic poses challenges for investors in both traditional and emerging asset classes as they navigate through the implications of ongoing currency fluctuations.

The MSCI index monitoring Asia-Pacific stocks, excluding Japan, reflects a slight increase of 0.04%, indicating a resilience amid global uncertainties. Furthermore, projections suggest that world stocks may close the year with gains exceeding 17%, a figure attributed largely to the robust performance of U.S. equities. Investors have been particularly drawn to sectors driven by artificial intelligence and buoyed by solid economic fundamentals in the United States.

Japan’s Nikkei index reported a promising performance, projecting gains over 17% for the year, showcasing the dynamism of the Asian markets despite external pressures. Conversely, Chinese indices exhibited mixed results, with the CSI 300 declining marginally but still on track for annual gains of over 10%. This phenomenon can be traced back to increased governmental support aimed at bolstering China’s lagging economy amid global economic challenges.

In the realm of cryptocurrencies, Bitcoin remained resilient, last trading at approximately $98,967 while navigating through volatility triggered by recalibrated Fed policies. The ascent of digital currencies is further supported by legislative changes in Russia, facilitating the use of cryptocurrencies in international transactions. This shift could herald a paradigm change in how currencies operate on the global stage, particularly against a backdrop of geopolitical tensions.

The commodities market has not been immune to these shifting dynamics either. Oil prices showed slight movements, with Brent crude and U.S. crude both gaining modestly amidst broader expectations of continued market volatility and historical production levels. Such trends are critical for investors who monitor these indices closely, as even minor fluctuations can influence larger investment decisions.

As the curtain falls on 2024 and investors brace for the new year, market conditions reflect a delicate balance of optimism juxtaposed against economic uncertainty. The interplay of interest rates, currency valuations, equity performances, and commodity prices will be pivotal in shaping the financial landscape of 2025. As traders recalibrate their strategies, the focus must remain on key economic indicators and potential shifts from central banking authorities, particularly the Federal Reserve. This nuanced understanding will be essential for navigating the complexities of the year ahead.