In the fast-paced environment of Asian financial markets, recent geopolitical developments have cast a shadow over investor sentiment. However, after a turbulent day punctuated by escalated concerns surrounding the U.S.-Russia conflict, the atmosphere appears to be stabilizing as the trading week progresses. Observers note a notable shift, whereby the bearish sentiment that dominated markets earlier in the week appears to be subsiding, giving way to cautious optimism among traders and investors alike.

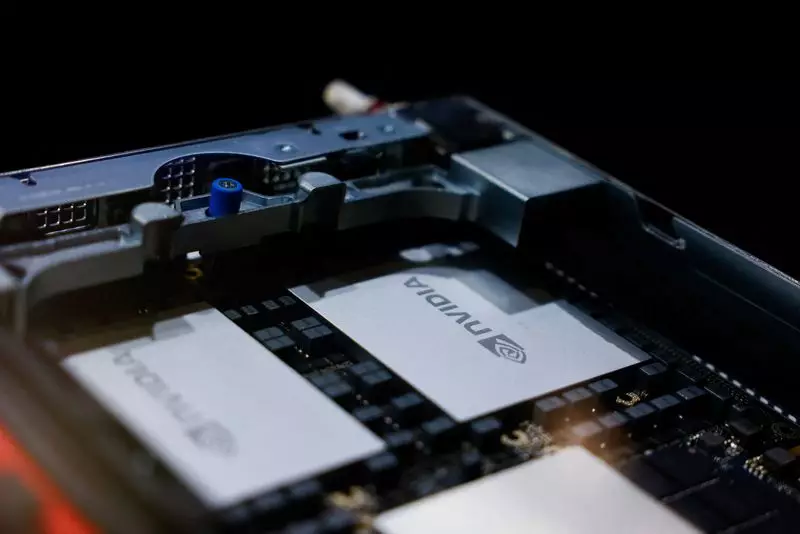

On Wednesday, as markets in Asia prepare for another trading day, anticipation builds around critical economic announcements. One of the focal points is Nvidia’s upcoming earnings report, with industry analysts estimating a staggering 82.8% increase in revenue. Such projections not only underscore Nvidia’s pivotal role in the technology landscape but also reflect broader consumer and business demand in the semiconductor industry. As markets digest these revelations, the implications for both regional and global economies cannot be overlooked.

As traders assess their positions, numerous economic reports are set to be released, particularly from South Korea, Japan, and Taiwan. The producer price inflation data from South Korea will be closely monitored, as it serves as a vital indicator of inflationary pressures within the economy. Similarly, trade figures from Japan and Taiwan will provide insights into regional supply chain dynamics. Taiwan’s exports, particularly those from TSMC, carry significant weight, revealing trends in global demand that may shape investment strategies moving forward.

Moreover, the attention directed towards these Asian economies is heightened by monetary policy decisions expected from local central banks. Analysts largely predict that both the People’s Bank of China and Bank Indonesia will maintain their current interest rates. This cautious approach indicates concerns over currency stability in the face of shifting geopolitical winds, particularly given the uncertainty surrounding U.S. trade policies anticipated under the next presidential administration.

Geopolitical Considerations and Their Market Impacts

The undercurrents of geopolitical instability are a significant theme influencing market behavior in Asia. The recent escalation in tensions between the U.S. and Russia has led to heightened volatility across global markets. The revelation that the U.S. is permitting Ukraine to utilize American-made weaponry for deeper strikes into Russian territory has elicited responses from Moscow, including a lower threshold for potential nuclear engagement. Such developments have understandably shaken investor confidence, briefly pushing major indices into the red and elevating volatility measures.

Despite these concerns, the subsequent recovery in U.S. markets—where the S&P 500 and Nasdaq saw gains—signals a possible return to stability. As the Asian markets prepare to open, the effects of these global sentiments will inevitably ripple across trading floors. Investors are now treading carefully, balancing caution and opportunity as they await pivotal data releases that could further influence market trajectories.

On the corporate front, Nvidia stands as a beacon of potential amidst prevailing uncertainties. As the largest player in the semiconductor industry, Nvidia’s performance holds substantial weight in market dynamics. Wall Street’s optimistic earnings forecast pegs its revenue for the current quarter at an impressive $33.125 billion. The successful realization of such expectations could provide not just a boost to Nvidia’s stock but could also bolster confidence in the technology sector as a whole.

This reliance on tech performance underscores the interconnectedness of various market sectors and highlights how a single company’s results can sway broader economic sentiments. Investors are, therefore, eager to gauge the results and forecast from Nvidia, which could serve as a crucial determinant for market behavior in the days to come.

Looking Ahead: Navigating Uncertainty

The Asian markets are currently navigating a complex tapestry of geopolitical nuances and economic indicators. While investor sentiment is tentatively improving, uncertainties remain prevalent, particularly regarding international relations and their economic ramifications. The forthcoming economic data and corporate earnings reports will play a pivotal role in shaping market trajectories, as stakeholders brace themselves for what lies ahead. With a measured approach, investors can position themselves to capitalize on opportunities while remaining vigilant of potential risks that may arise from the ever-changing landscape of global politics.