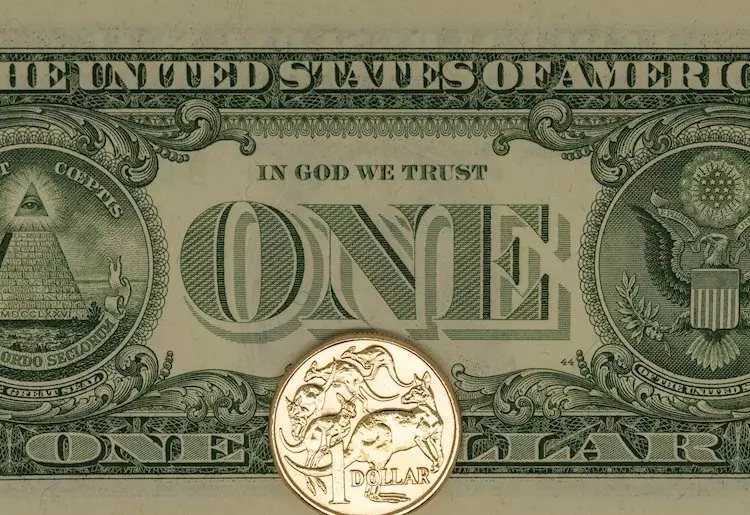

On Wednesday, the Australian Dollar (AUD) in relation to the US Dollar (USD) experienced a notable decline, nosediving to a five-week low beneath the pivotal level of 0.6700. The currency pair witnessed a drop of 0.60%, closing at 0.6662, raising concerns about its potential trajectory as it breached crucial support. As traders brace for the release of key employment statistics from Australia, due on Thursday, various interrelated factors are contributing to the recent depreciation of the AUD.

Several dynamic elements are contributing to the downward pressure on the AUD. One primary force is the resurgence of the USD, which is primarily driven by renewed confidence in the US economy and ongoing expectations regarding interest rate policy. Additionally, the prevailing trepidation surrounding the state of the Chinese economy, coupled with declining metal prices, has further compounded the bearish sentiment for the AUD.

Uncertainty regarding China’s economic stimulus measures has also created a ripple effect, leading to skepticism among market participants. This ambivalence can be attributed to recent press events where the Chinese authorities underscored the challenges in implementation, causing traders to weigh the potential implications for Australian exports, especially in sectors heavily reliant on China’s demand, including commodities like iron ore.

Investors are keenly anticipating the forthcoming employment data from Australia, including the Employment Change and Participation Rate from September. These figures are crucial indicators of the health of the Australian labor market. A disappointing print could lead to speculation around future rate cuts by the Reserve Bank of Australia (RBA). Recent sentiment indicates that market expectations are currently tilted towards a muted rate cut of 0.25% in the upcoming year. However, weak employment outcomes may rekindle fears of further easing, adding more pressure on the AUD/USD pairing.

The RBA’s commitment to targeting an inflation rate of 2-3% can also be seen as a double-edged sword for the AUD. On one hand, high interest rates aimed at taming inflation bolster the strength of the currency. Conversely, if economic conditions deteriorate, the RBA’s inclination to cut rates could weaken the AUD further.

Currently, the AUD/USD pair is situated within a bearish trend, which is corroborated by technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). The RSI indicates an oversold condition, suggesting that the intense selling pressure may soon stabilize, as traders look for potential consolidation points. Conversely, the MACD continues to rise, despite the overarching bearish outlook, indicating that there may still be market participants looking to capitalize on short-term corrections.

Identifiable support and resistance levels are critical for traders. For the AUD/USD, immediate support is found at 0.6660, with further levels lying at 0.6650 and 0.6630. Conversely, significant resistance is marked at 0.6700, as well as 0.6730 and 0.6750. These thresholds will be pivotal as the currency reacts to the evolving economic landscape.

As a resource-rich nation, Australia’s economy is profoundly influenced by global commodity prices, with iron ore holding a central position. Notably, China remains Australia’s largest trading partner, thus creating a symbiotic relationship where demand for Australian exports directly correlates with the performance of the Chinese economy.

High iron ore prices generally lead to a strengthened AUD, as they bolster the trade balance through increased export revenues, ultimately resulting in a favorable economic environment. However, the struggle with commodity pricing poses significant risk; falling prices diminish revenue, weakening the AUD and potentially triggering wider economic repercussions.

The Trade Balance also plays an essential role in shaping the value of the Australian Dollar. A consistent trade surplus reinforces demand for the AUD, while a deficit can erode currency strength. Hence, any signals reflecting changes in trade policies or shifts in demand from key partnerships like China must be closely monitored by investors.

As the AUD/USD currency pair navigates this tumultuous economic environment, traders remain vigilant. The interplay between domestic employment data, global economic sentiment, and commodity price fluctuations will be crucial in determining the pair’s path forward. The upcoming labor statistics could serve as a catalyst, potentially leading to marked shifts in market expectations. Thus, while the immediate outlook appears bearish, the potential for recovery remains contingent on forthcoming data and geopolitical developments, particularly in relation to Australia’s commercial partnerships.