As the New Year unfolds, Asian financial markets are showing signs of resilience despite a rocky start to 2025. After an impressive climb throughout 2024, which saw regional stocks rise nearly eight percent, the prevailing sentiment is cautiously optimistic. On this particular Friday, MSCI’s Asia-Pacific index, which excludes Japan, recorded a modest increase of 0.33%. However, it is poised for a weekly loss approaching one percent. These fluctuations signal the ongoing struggle investors face as they reconcile positive long-term outlooks with immediate economic challenges.

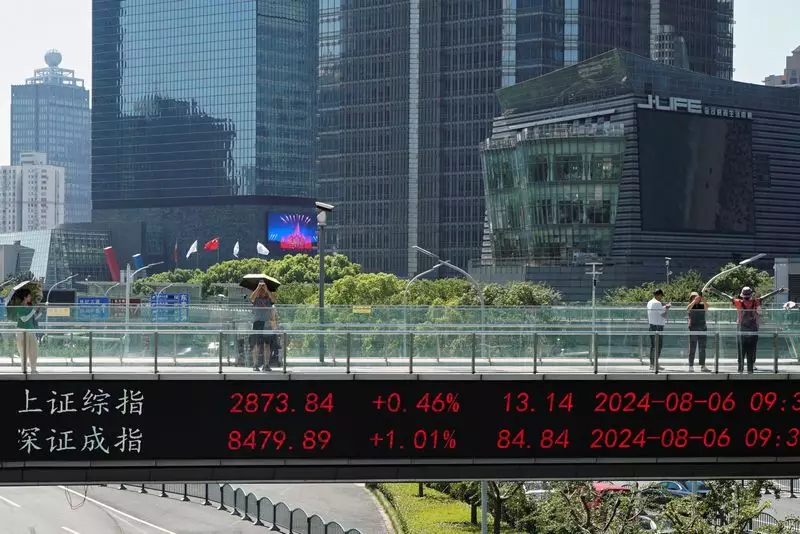

Japan’s markets are currently inactive, as they are closed for the week, leaving a gap in regional trading dynamics. Meanwhile, the Chinese market showed some stabilization following a significant drop earlier this week. The CSI 300 index, which represents major Chinese firms, increased marginally by 0.16%. However, this did little to alleviate concerns stemming from China’s economic trajectory and potential geopolitical tensions as the Trump administration prepares to take office in the U.S.

Market analysts are weighing the implications of recent economic developments. Ben Bennett, an Asia-Pacific investment strategist, described the market conditions as challenging yet full of potential. He suggests that the conditions in thinly traded markets can lead to unexpected price movements. Bennett emphasizes the need for caution, noting that a stronger dollar alongside rising bond yields could dampen investor enthusiasm in the near term.

In the broader context, U.S. markets have not helped bolster confidence. Following a significant decline in stocks on Wall Street, highlighted by a notable drop in Tesla shares after a disappointing annual delivery report, the mood among investors remains somber. This trend comes after a year that had previously been buoyed by excitement over advancements in artificial intelligence and expectations for a shift towards lower interest rates by the Federal Reserve. However, recent shifts in Fed guidance, suggesting fewer rate cuts, have created uncertainty in the market.

Geopolitical Tensions and Economic Data Shape Outlook

The anticipation of Trump’s economic policies, which are seen as potentially inflationary, is adding layers of complexity to the investment climate. OCBC’s Vasu Menon pointed out the dual-edged nature of Trump’s pro-business agenda. While it may invigorate the U.S. economy, it could constrict global growth through tariffs and a strengthening dollar, raising alarms among traders worldwide.

Recent U.S. labor market data has provided some reassurance, indicating fewer unemployment benefit claims than anticipated. The drop to an eight-month low of 211,000 illustrates a diminishing rate of layoffs, suggesting a healthy employment landscape, which could bode well for consumer spending and broader economic activity. As investors look ahead to payroll and inflation numbers set to release later this month, the landscape remains rife with uncertainty and speculation regarding fiscal policy.

The stronger dollar is transforming the currency landscape, with the dollar index reflecting its robust performance at around 109.2, staying just shy of its recent two-year highs. Factors inflating the dollar’s strength include recalibrated interest rate expectations and market adjustments following changes in Federal Reserve projections. The euro has taken a particular hit in this environment, declining to its lowest value against the dollar in over two years, with traders keenly observing its downward trajectory.

The Japanese yen has also faced challenges, straying near five-month lows as it continues its decline, marking four consecutive years of losses. As fiscal policies evolve and global markets react, the interplay between currencies adds another layer of complexity for investors looking to navigate these waters.

Despite the clouds over equities, there are signs of cautious optimism in commodity markets. Rising oil prices signal renewed confidence regarding demand, particularly in light of initiatives from China’s President Xi Jinping to stimulate growth. Brent crude has edged upwards, responding positively to these developments. Similarly, gold prices have shown resilience, maintaining levels above $2,600 per ounce after a substantial rise throughout 2024. This performance represents a significant rebound for a commodity that has historically served as a safe haven in turbulent times.

As Asian markets grapple with a mixed bag of external pressures, investor focus is firmly fixed on both geopolitical developments and upcoming economic indicators. The interaction between U.S. policy shifts, global trade concerns, and regional growth initiatives will determine the direction of markets in this uncertain phase. Caution is the watchword, as the road ahead promises to be as complex as the trends seen at the turn of the year.