As fresh waves of political uncertainty ripple through the Eurozone, the Swiss Franc (CHF) is experiencing a notable strengthening against the euro. Investors are increasingly seeking the security that this safe-haven currency offers, particularly in light of instability stemming from political actions in France. However, the implications of a stronger CHF are not straightforward for Switzerland’s economy, which is heavily reliant on exports.

Recent events, particularly movements from leftist and far-right factions in France aimed at unseating Prime Minister Michel Barnier over contentious budget cuts, have reignited concerns regarding the stability of the Eurozone. This has led analysts at Bank of America to spotlight the CHF as a popular tool for hedging against these uncertainties. Switzerland’s economic ties with the Eurozone necessitate a keen awareness of how fluctuations in the CHF could adversely impact export-driven sectors.

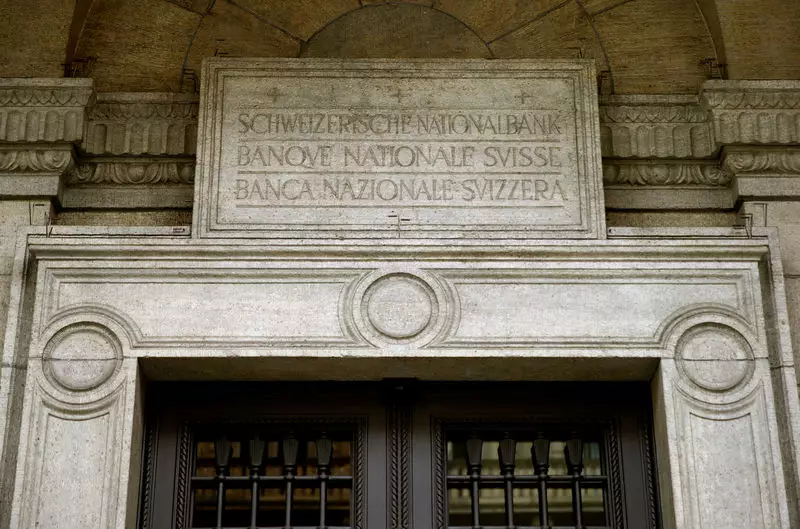

Interestingly, while political drama in Europe traditionally augments the appeal of the CHF, the current scenario reveals that this strengthening is not universally alarming to the Swiss National Bank (SNB). According to analysts’ perspectives, the SNB remains vigilant but appears untroubled by the Franc’s performance relative to its G10 peers, indicating that the currency’s recent movements may not warrant immediate intervention.

Bank of America analysts also emphasize that the gradient decline of EUR/CHF is likely more a result of short CHF positioning, rather than an influx of safe-haven investments. Seasonal trends further complicate the narrative; historically, December has been a month characterized by a weaker EUR/CHF, with declines noted in 70% of the last decade’s observations. Such patterns weaken the argument for aggressive interventions by the SNB, as the fundamentals of political uncertainty have yet to elicit meaningful safe-haven flows.

The SNB’s lack of imminent intervention suggests a complex dance between maintaining currency stability and allowing the market to dictate movements based on broader conditions. If a stronger CHF starts to pose significant risks to the economy, particularly in the export domain, the SNB may reconsider its stance. Yet for now, the absence of alarming outperformances against G10 counterparts paints a picture of caution rather than immediate action.

In light of the evolving economic landscape, analysts propose that while the CHF will likely maintain its status as a refuge amid Eurozone uncertainties, there exists potential value in adopting bearish positions against the currency in scenarios where policy divergence is evident—particularly against the British Pound (GBP) and the U.S. Dollar (USD).

While the recent strengthening of the Swiss Franc spotlights its role as a safe haven amidst geopolitical strife, the broader ramifications for Switzerland’s export-centric economy demand careful monitoring. The evolving dynamics of the Eurozone’s political climate and the SNB’s future policy decisions will be crucial in determining whether the CHF continues its ascent or is stabilized through proactive measures.