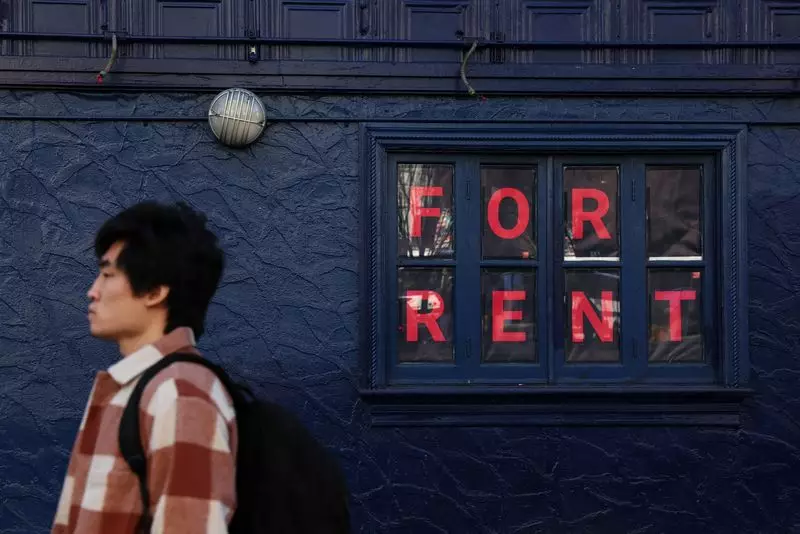

Recent analyses from the Federal Reserve Bank of Cleveland have unveiled a critical concern regarding the ongoing strain of rent inflation on American consumers. As the economy gradually shifts from the unprecedented effects of the pandemic, the anticipated relief remains elusive. The Cleveland Fed’s findings indicate that rent inflation is set to stabilize above pre-pandemic levels, lingering at around 3.5% until at least mid-2026. This trend not only underscores the continuing inflation crisis but also amplifies the complexities faced by policymakers in their quest to achieve an overall inflation target of 2%.

The notable divide between new rents and those of existing leases is one of the primary drivers of this persistent rent inflation. Analysts have drawn attention to the widening gap in rental prices, which is significantly more pronounced than before the onset of the pandemic. In September 2024, the estimated gap stood at approximately 5.5%, showcasing a substantial amount of potential rent inflation that still needs to transition to existing tenants. This phenomenon creates an untenable situation where new rental prices continue to rise, while established contracts lag, causing ongoing financial strain for many renters.

The implications of this gap are particularly concerning. As new high rents are normalized in the market, existing leases may require adjustments, leading to sudden and steep rent hikes for tenants. This uncertainty can destabilize household budgets, leaving many households grappling with financial insecurity even as the economy recuperates from pandemic pressures.

In response to these inflationary pressures, the Federal Reserve appears cautiously optimistic about the overall retreat of inflation to the desired 2% target. The commencement of a rate cut initiative signifies a commitment to normalizing monetary policy, with hopes that reduced interest rates will eventually alleviate some of the burdens within the housing market. However, the path forward is fraught with challenges. For instance, while Fed officials anticipate that inflation might trend downward, the stubbornness of rent prices complicates these optimistic forecasts.

Prominent Fed figures, including St. Louis Fed President Alberto Musalem, project a decline in the housing component of price indexes as rent inflation wanes over time. Musalem cites a solid pace of deceleration in rent growth, notably pointing out that annualized rent growth through September 2023 stood at 4.6%, down from a peak of 6.8%. Nevertheless, such projections hinge on a favorable economic landscape that includes a healthy labor market and effective policy measures responding to the unique aspects of the housing market.

Among various components of inflation, shelter prices have emerged as a particularly sticky factor, remaining steadfastly above pre-pandemic averages. Boston Fed chief Susan Collins emphasized that the clinginess of shelter inflation primarily derives from existing rents catching up to new market rents. Her insights shed light on the entangled relationship between job market conditions and rent pricing dynamics. If job growth slows—leading to diminished demand for housing—new rents may eventually stabilize, subsequently hinting at a potential easing in existing lease renewals.

The intricate interplay between labor market stability, rent prices, and inflation forecasts poses significant challenges for economic recovery strategies. The Fed must navigate these complexities with finesse, balancing the need for a supportive monetary environment while addressing the realities of rent inflation pulling consumers in contradictory directions.

The insights provided by the Cleveland Fed highlight a troubling landscape for consumers caught in the vise of rent inflation. With a persisting gap between new and existing rental prices, coupled with the stickiness of shelter prices, the road to achieving a stable inflation rate remains long and arduous. It is imperative for economic policymakers to remain vigilant, adapting to the evolving dynamics of the housing sector. Only through concerted efforts and strategic measures can the goals of economic stability and consumer relief be realistically pursued in the face of ongoing inflation pressures.