In a bid to invigorate domestic consumption and bolster economic growth, China’s government recently launched an ambitious trade-in policy. An allocation of 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds was announced to subsidize trade-ins for consumer goods such as cars, home appliances, and larger machinery. However, despite the optimism surrounding this initiative, skepticism persists within the business community regarding its effectiveness and implementation. This article delves into the challenges and realities of China’s trade-in policy, critically evaluating its potential impact on consumption and retail sales.

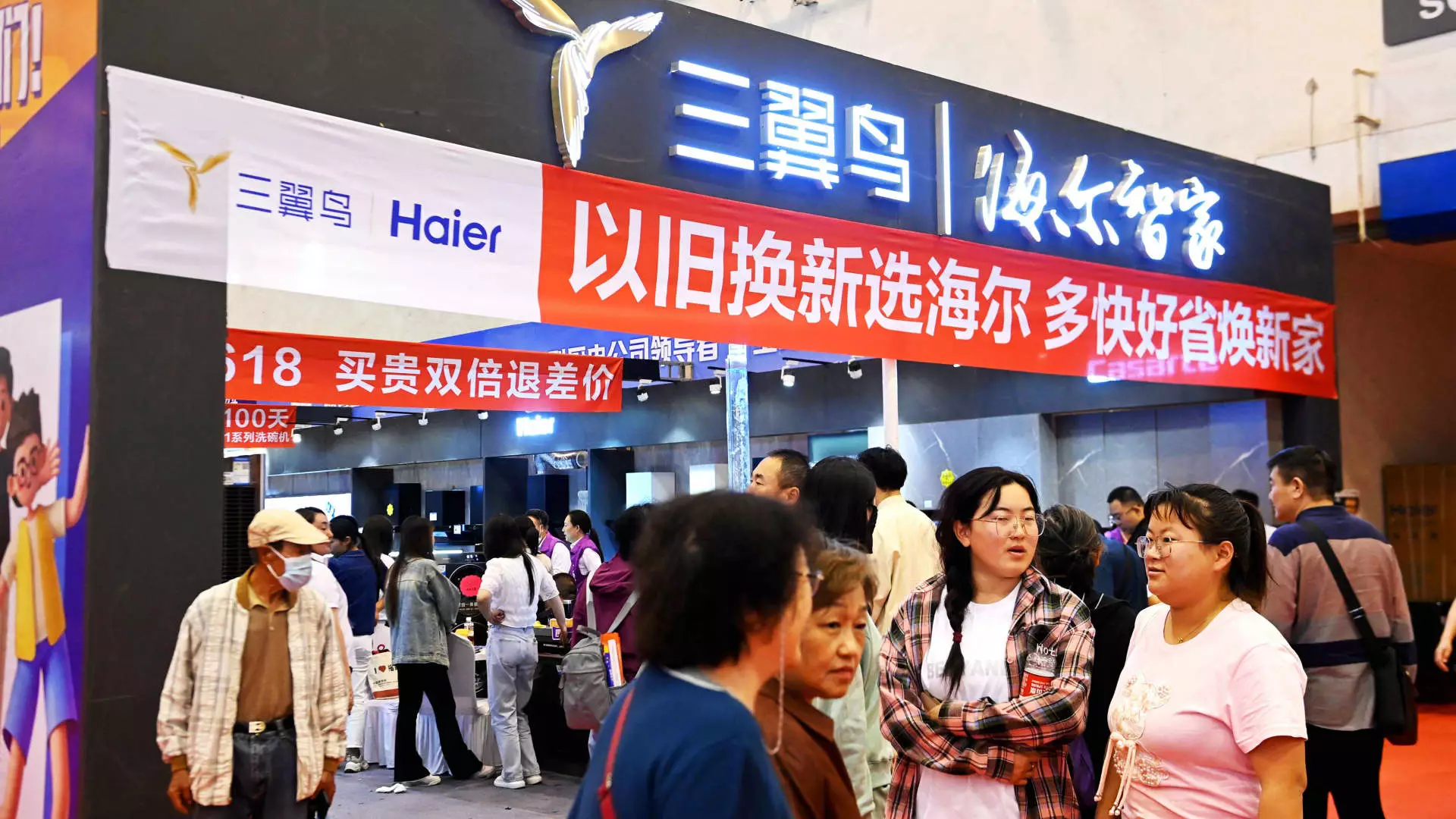

China’s trade-in initiative is part of a broader strategy to transition the economy from a reliance on investment and exports to sustained consumer-driven growth. By encouraging consumers to trade in old products for new ones, the government aims to increase spending while simultaneously stimulating demand for domestic manufacturers. Notably, half of the funds allocated are directed towards the automobile and home appliance sectors. However, as businesses and analysts have pointed out, the program’s reliance on consumers having liquid assets and a used product to trade in may hinder its success from the get-go.

A critical obstacle to the initiative’s success lies in consumer sentiment and spending behavior. The economic constraints posed by a cautious consumer base make it challenging for Beijing to stimulate the desired level of consumption through subsidies alone. Jens Eskelund, president of the EU Chamber of Commerce in China, highlighted that, while the measures focus on execution, tangible results on the ground remain absent. Consumers must still navigate the complexities of potential upfront costs, which can deter participation in the trade-in program.

The challenge manifests in the numbers. Analysts have suggested that even under the best circumstances, the trade-in policy may contribute merely 0.3% to China’s retail sales in 2023. With recent retail sales growth barely scratching the surface at 2% in June—marking the slowest increase since the COVID-19 pandemic—there is little indication that the trade-in program will yield significant short-term economic benefits.

Diving deeper into the sector-specific implications, the automobile sector has seen a notable increase in new energy vehicle sales, surging nearly 37% in July even against the backdrop of declining passenger car sales. The trade-in policy has substantially boosted subsidies for both new energy and traditional gasoline-powered vehicles. However, the evident disparity between consumer interest in electric vehicles and more traditional trade-ins may complicate the narrative of this initiative.

Conversely, the equipment sector, such as external elevator services, reports stagnation in new orders directly tied to the newly introduced policies. Industry leaders like Otis and Kone remain optimistic about potential long-term gains, but the immediate evidence of governmental funds translating into business in this segment is lacking. Despite regional interest from local governments, there is a palpable delay in the clarity and distribution of funds, leaving companies uncertain about how to proceed with expected orders.

As with any governmental initiative, the efficacy of the trade-in program will ultimately come down to its execution and local government support. Recent developments indicate that several major cities have recently begun rolling out detailed plans on how residents can participate in the trade-in scheme. The onus may lie heavily on local governments to ensure that the funding reaches communities effectively and serves the intended purpose. For companies like ATRenew, which processes secondhand goods, there is cautious optimism about the long-term development of a robust secondhand goods market, aided by this government initiative.

The trade-in policy represents a significant and crucial step towards reworking consumption dynamics within the Chinese economy. While the proposed initiative is well-intentioned, the reality reveals substantial challenges that must be navigated for successful execution. Immediate effects may be limited, and the program’s ultimate success will depend on an adaptive consumer base, reliable government coordination, and tangible results. As of now, the road ahead is fraught with uncertainties, but there is hope that with time and effective local implementation, both consumers and businesses may find their footing in this evolving economic landscape.