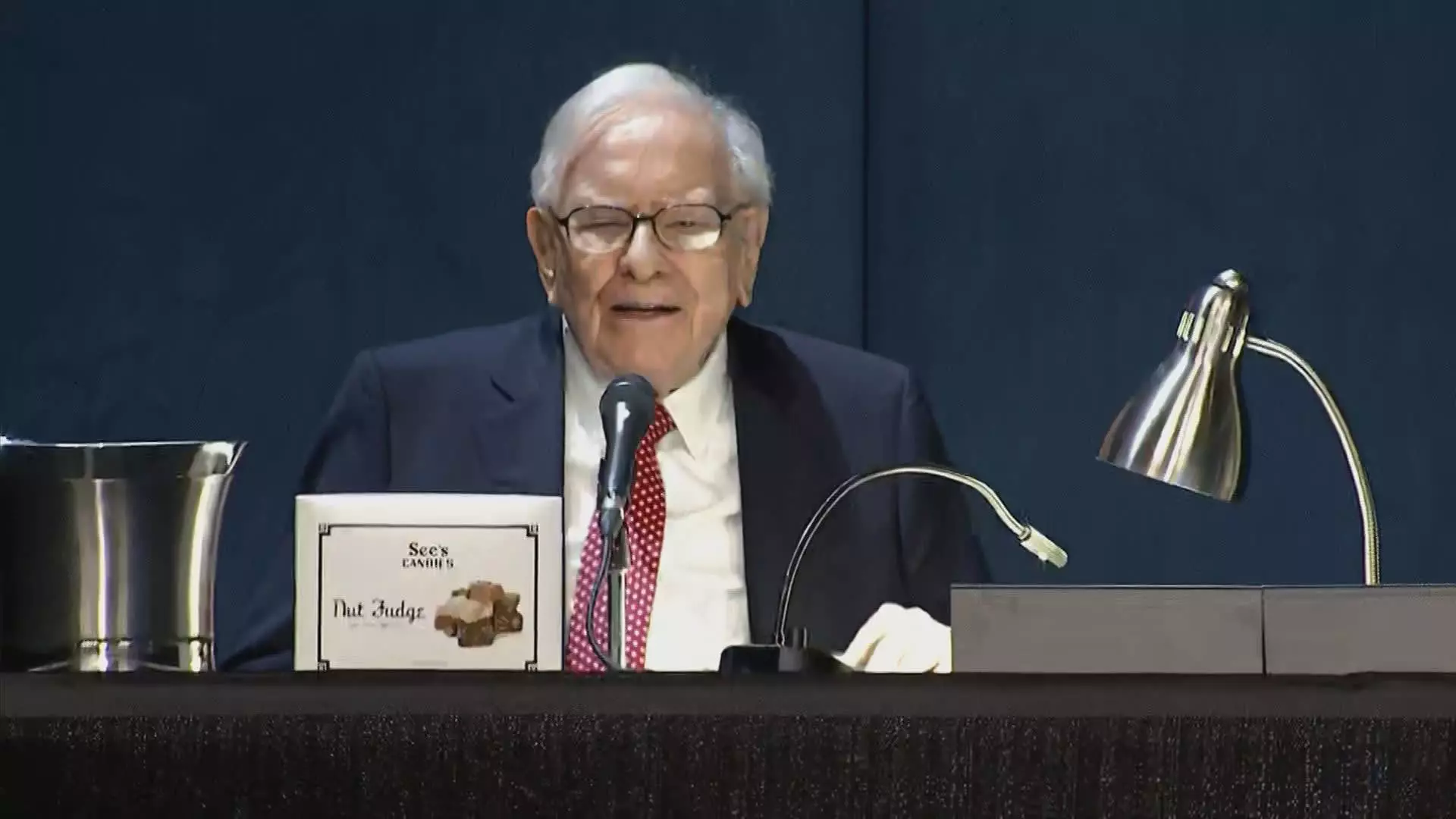

Warren Buffett’s Berkshire Hathaway has been in the spotlight recently after offloading a significant amount of Bank of America shares, totaling over $7 billion since mid-July. This move has reduced Berkshire’s stake in the bank to 11%. The conglomerate sold a total of 5.8 million BofA shares in separate sales over three consecutive days, fetching almost $228.7 million at an average selling price of $39.45 per share. This selling streak has spanned 12 straight sessions, mirroring a similar streak from July 17 to August 1. With more than 174.7 million shares sold, Berkshire now holds 858.2 million shares of BofA, making it the third-largest holding in its portfolio, behind Apple and American Express.

Buffett’s relationship with Bank of America dates back to 2011 when he purchased $5 billion worth of BofA’s preferred stock and warrants in the aftermath of the financial crisis. By converting those warrants in 2017, Berkshire became the largest shareholder in the bank. Buffett further increased his bet on BofA by adding 300 million more shares in 2018 and 2019. However, the recent selling spree has raised eyebrows, with BofA CEO Brian Moynihan admitting that he is unsure of Buffett’s motivations for selling. Despite this, Moynihan acknowledged the positive impact Buffett has had on the bank, stabilizing it during times of crisis and generating significant returns for himself.

Shares of Bank of America have seen a slight dip of about 1% since the beginning of July, but the stock has risen by 16.7% overall this year, outperforming the S&P 500. Moynihan praised Buffett’s shrewd investment in the bank in 2011, highlighting how investors who followed Buffett’s lead could have bought BofA stock at a low price of $5.50 per share, which has since increased to nearly $40 per share. Moynihan credited Buffett for his bold move and recognized the substantial returns he has achieved through his investment in the bank.

Warren Buffett’s decision to sell a significant portion of Bank of America shares has sparked speculation about his future investment plans. While the exact reasons behind Buffett’s selling spree remain unknown, his history with the bank and the positive impact of his investment are undeniable. As Berkshire Hathaway continues to adjust its portfolio, the financial world will be watching closely to see what moves Warren Buffett makes next.