The recent release of Chinese economic data, including the Consumer Price Index (CPI) and Producer Price Index (PPI), has generated mixed reactions in the financial markets. While the CPI rose by 0.6% in August, falling short of market expectations, the PPI declined by 1.8% year-on-year. These figures have implications not only for the Chinese economy but also for other countries with close economic ties to China, such as Australia.

The Australian Dollar (AUD) is influenced by a variety of factors, including interest rates set by the Reserve Bank of Australia (RBA), the price of key exports like Iron Ore, and the health of the Chinese economy. The RBA plays a crucial role in determining the level of interest rates in the economy, with higher rates often supporting the AUD and lower rates having the opposite effect. Inflation, growth rates, and trade balances also contribute to the overall value of the Australian Dollar.

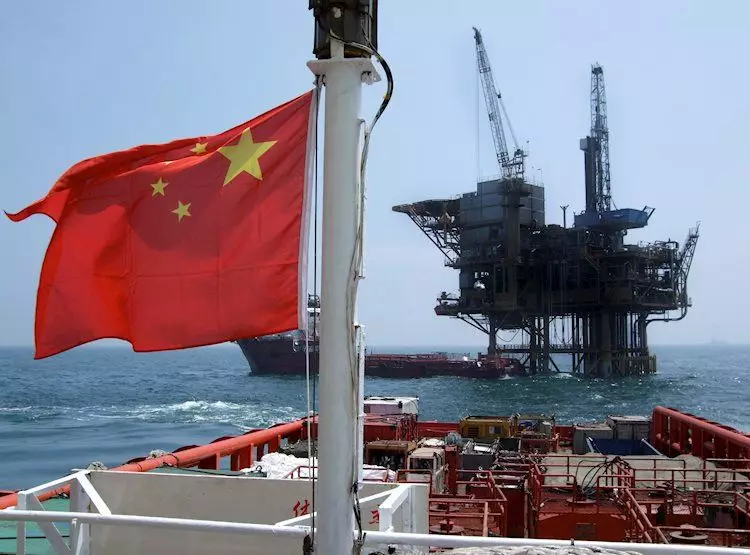

As China is Australia’s largest trading partner, the health of the Chinese economy directly affects the value of the Australian Dollar. Positive economic growth in China leads to increased demand for Australian exports, such as raw materials and goods, boosting the AUD. Conversely, any slowdown in Chinese growth can have a negative impact on the Australian Dollar, as demand for exports decreases.

Iron Ore is Australia’s most significant export, and its price has a direct impact on the Australian Dollar. Higher Iron Ore prices generally lead to an appreciation of the AUD, as demand for the currency rises. This is due to increased demand for Australian exports and a positive effect on the country’s trade balance. Conversely, a decline in Iron Ore prices can weaken the Australian Dollar.

The Trade Balance, which reflects the difference between a country’s exports and imports, is another factor influencing the value of the Australian Dollar. A positive Trade Balance, where exports exceed imports, tends to strengthen the AUD as foreign buyers seek to purchase Australian goods and services. On the other hand, a negative Trade Balance can put downward pressure on the currency.

The Australian Dollar is closely tied to Chinese economic data and global market trends. Understanding the impact of key factors such as interest rates, Iron Ore prices, and trade balances is essential for investors and traders looking to navigate the complexities of the foreign exchange market. By keeping a close eye on developments in China and other major trading partners, it is possible to make more informed decisions regarding the Australian Dollar and its potential fluctuations in value.