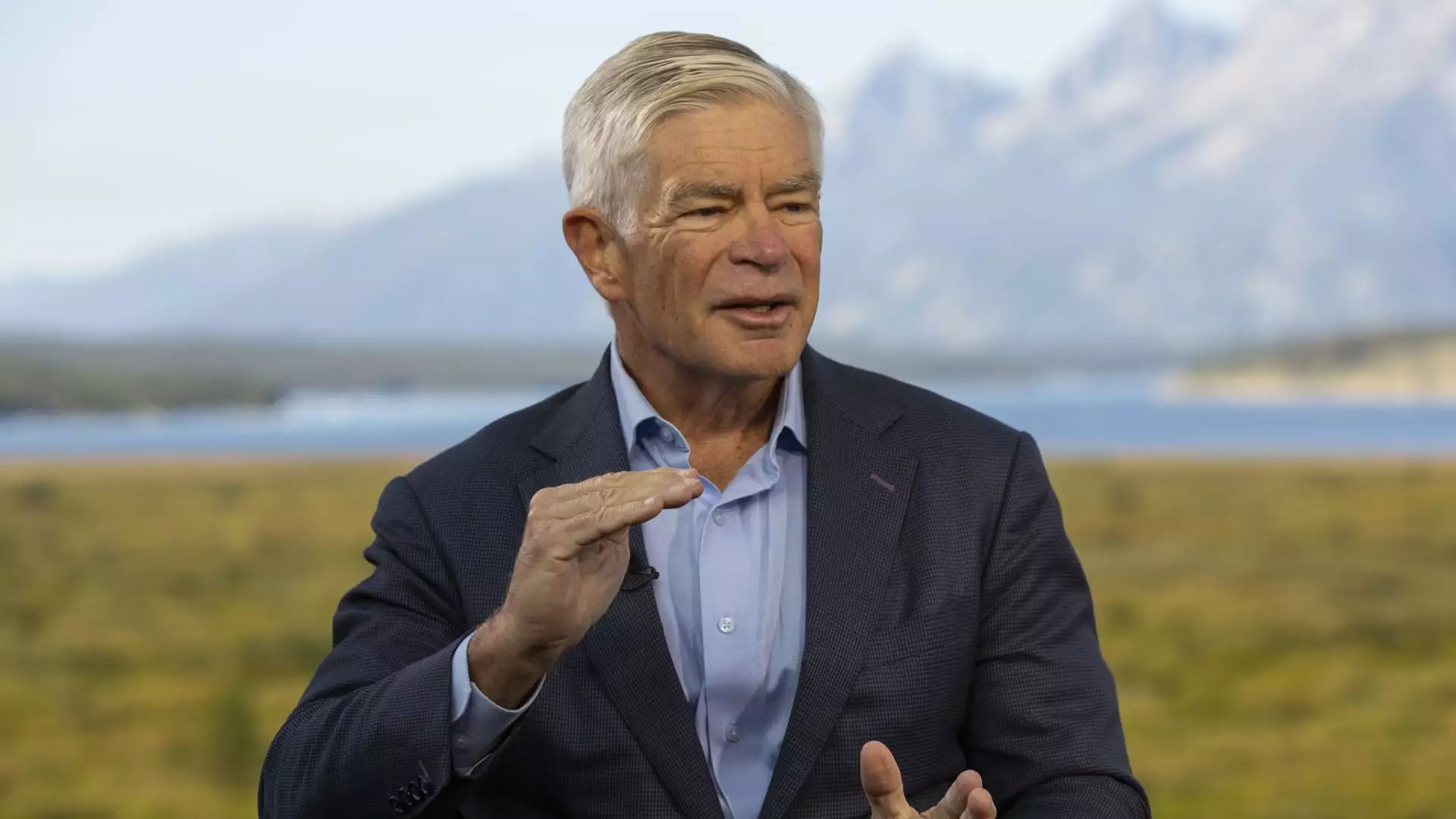

Philadelphia Federal Reserve President Patrick Harker recently expressed a strong endorsement for an interest rate cut to be implemented in September. Speaking from the Fed’s annual retreat in Jackson Hole, Wyoming, Harker stated that monetary policy easing is almost certain in the upcoming meeting. This direct statement marks a significant shift in the Fed’s stance, signaling a proactive approach to address potential weaknesses in the economy.

Although markets are pricing in a high probability of a quarter percentage point cut, with some speculating on a larger 50 basis point reduction, Harker remains cautious in his assessment. He emphasized the need for additional data before solidifying his decision on the magnitude of the rate cut. This uncertainty reflects the complexities and challenges faced by policymakers in navigating the current economic landscape.

Harker’s stance is grounded in a careful analysis of key economic indicators, particularly inflation and the labor market. The Fed’s commitment to data-driven decision-making is crucial in guiding policy adjustments. The recent trend of cooling job indicators and a gradual increase in the unemployment rate are key factors influencing the decision to cut rates. This nuanced approach underscores the Fed’s efforts to balance economic growth with stability.

Harker reaffirmed the Fed’s commitment to political independence and a technocratic philosophy in policymaking. As the presidential election looms in the background, he emphasized the importance of data analysis and evidence-based responses. The Fed’s role as a proud technocrat highlights its dedication to objective decision-making, free from external pressures. Harker’s position reflects the institution’s core values and mission in steering the economy.

While Harker’s voice carries weight in the discussion, he does not have a voting position this year on the rate-setting Federal Open Market Committee. However, his insights contribute to the collective deliberations shaping future policy directions. Other Fed officials, such as Kansas City Fed President Jeffrey Schmid, have also hinted at a possible rate cut in the near future. The collaborative nature of these discussions underscores the complexity of monetary policy decisions and the diverse perspectives involved.

Evaluating Banks and Policy Impact

Schmid’s assessment of banks’ resilience under the current high-rate environment offers a more nuanced perspective on the potential impacts of a rate cut. While acknowledging the benefits of a cooling labor market in curbing inflationary pressures, he cautions against premature assumptions about the overall policy stance. The interplay between economic indicators, market expectations, and policy considerations underscores the intricacies of policymaking in a dynamic economic environment.

The case for an interest rate cut in September reflects a comprehensive analysis of economic trends, market expectations, and policy objectives. The Fed’s commitment to data-driven decision-making, political independence, and collaborative input underscores the institution’s role as a key player in shaping the economic landscape. As policymakers navigate uncertainties and complexities, a balanced approach that considers a range of factors will be critical in determining the timing and magnitude of future rate adjustments.