In a surprising turn of events, newly confirmed Federal Reserve Governor Stephen Miran broke ranks with the majority during the latest policy meeting by advocating for a substantial half-percentage point cut to interest rates, rather than the quarter-point reduction endorsed by the committee. His dissent signals a shift in the Fed’s approach to managing inflation, growth, and financial stability. Traditionally, central banks aim for measured adjustments, often hesitating to take aggressive stances due to concerns about market volatility or undermining confidence. Miran’s call for a larger rate cut reflects a more hawkish tilt towards stimulating the economy and possibly addressing underlying concerns about sluggish growth or persistent inflation pressures.

This divergence raises fundamental questions about the future trajectory of U.S. monetary policy. If one new member can substantially oppose the consensus, it suggests a brewing confidence among some officials to challenge the status quo. Miran’s stance signifies a shift from cautious incrementalism towards a more proactive, and perhaps more disruptive, approach. His advocacy for a 50 basis point reduction hints at underlying economic anxieties or a desire to more aggressively support employment and growth, even if it risks fueling inflation or destabilizing financial markets.

Political Overtones and the Influence of Leadership

The timing of Miran’s dissent, shortly after his Senate confirmation, is hardly coincidental. His appointment by President Trump, who has openly expressed disdain for the current pace of rate cuts, underscores the political undertones influencing monetary policy decisions. Trump’s previous calls for a rate decrease of two to three percentage points contrast sharply with the Fed’s more modest plans, indicating a desire for more aggressive easing to boost economic growth or to gain a political advantage.

Furthermore, Miran’s position on the Fed board, which could last until 2026, is seen by many as part of a broader strategy by Trump to assert influence over the central bank’s policies. Critics argue that such appointments threaten the independence of the Fed, blurring the lines between politics and monetary policy. Miran’s stance, alongside Trump’s vocality, suggests a desire for a looser monetary policy that aligns with political objectives rather than purely economic considerations. This tension calls into question whether the Fed’s independence can withstand political pressures in the long term, especially as dissenters like Miran push for policies that may be politically motivated or driven by short-term economic gains.

The Broader Implications of Divergent Views Among the FOMC

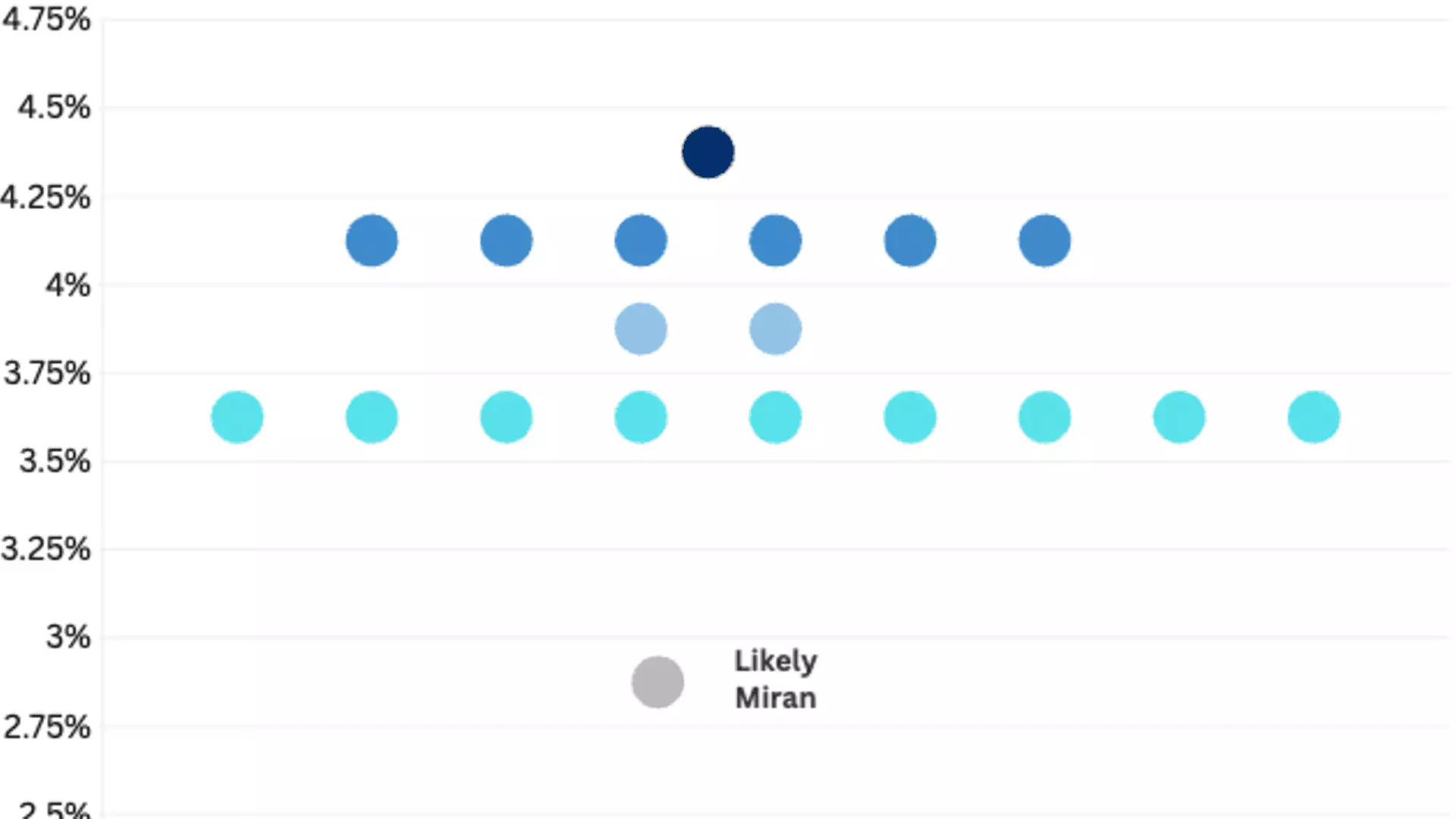

The Fed’s dot plot, an anonymous forecast representing members’ expectations for future interest rates, reveals a wide divergence in outlooks. While most members anticipate only a couple of additional rate cuts in 2025, some, possibly including Miran, foresee more aggressive easing, extending into 2026 with as many as four cuts. This disparity highlights a looming debate over the direction of U.S. monetary policy, with implications that could ripple across markets, borrowing costs, and economic forecasts.

In particular, the contrast between Miran’s radical approach and the more conservative projections underscores a potential polarization within the Fed. Such discord could lead to volatile policy signals, confusing investors and businesses about the central bank’s true intentions. Moreover, Miran’s push for a more aggressive easing policy also echoes the demand from political figures like Donald Trump, who has publicly called for even lower rates. This convergence of political and economic interests might accelerate the push towards unconventional policy maneuvers, risking a loss of credibility and stability if discord persists.

Miran’s unique position—balancing a role as a government appointee with a seat on the Fed—places him at a nexus where politics and economic policy intersect. His stance could pave the way for a more divided, unpredictable monetary policy landscape, challenging the traditional independence of the central bank. While some may welcome a more aggressive approach to stimulate growth, others must critically evaluate the long-term risks such policies might entail, including inflationary pressures and financial market instability.