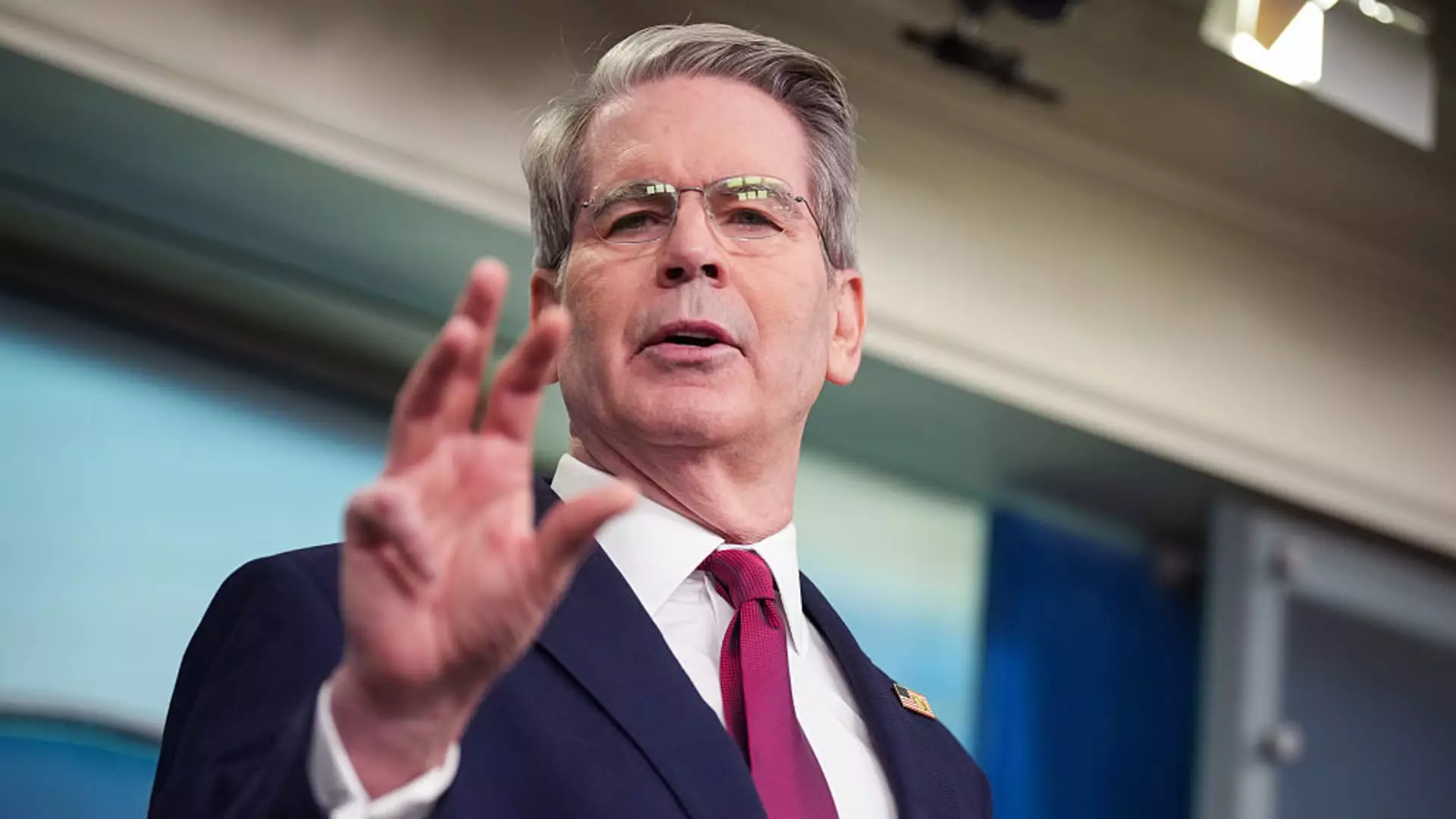

In a world increasingly defined by volatility and uncertainty, the unwavering confidence of individual investors is both a curious and optimistic phenomenon. Treasury Secretary Scott Bessent recently emphasized this notion in a press briefing, noting that everyday investors have largely refrained from selling their positions, even in the face of the tumultuous stock market and the controversial tariff policies of the Trump administration. While institutional investors appear to be retreating amid fears of an economic downturn, individual investors display a steadfast resolve grounded in trust for the president’s economic agenda.

Bessent highlighted a noteworthy statistic: over the past 100 days, a staggering 97% of Americans have refrained from executing trades, according to data from Vanguard. This lack of action suggests a deep-seated belief among retail investors that the fundamentals underpinning the market have not fundamentally shifted. In contrast, institutional investors, often regarded as more sophisticated and well-informed, appear more skittish. Their readiness to panic demonstrates a divergence in market sentiment – a psychological battle between trust and fear.

Market Turmoil and Institutional Hesitation

The recent fluctuations in the stock market have undoubtedly disheartened many. The onset of the highest tariffs seen in recent generations triggered a wave of panic, sending the S&P 500 briefly into a bear market. Such dramatic swings evoke memories of the crash in 2020, leaving many to question the stability of the economic framework established under Trump’s leadership. The turbulence has created a landscape where institutional players are increasingly concerned about the ramifications of persistent trade wars, which could potentially plunge the U.S. economy into recession.

Interestingly, during the depths of market chaos in April, it was retail investors who stepped into the fray, capitalizing on low stock prices and demonstrating an instinctive buying power. This behavior underscores a broader trend where individual investors, often guided by sentiment and instinct rather than institutional analysis, are prepared to bet on recovery. However, the sentiment is not shared universally, leading to a clash between the typically rational strategies of hedge funds and the emotional decisions of everyday investors.

Foreboding Economic Signals

As concerns mount about potentially steep tariffs, analysts are beginning to predict troubling economic forecasts. Chief economist Torsten Slok of Apollo speculates that a recession could be looming, exacerbated by trade-related supply shortages affecting consumer goods. Such predictions reflect a broader fear that President Trump’s trade policies could unsustainably alter the dynamics of consumer spending and market behavior. Ken Griffin, the founder and CEO of Citadel, warns of the long-term repercussions for the U.S. as it struggles to maintain its global economic reputation amid ongoing tariffs and trade disputes, which could ultimately tarnish the appeal of U.S. Treasury investments.

Ultimately, we stand at a crossroads. On one hand, individual investors exhibit a dogged resilience and willingness to trust in long-term growth, while institutional investors grapple with the associated risks, hinting at broader systemic concerns within the market. The divergence in sentiment raises essential questions about future market stability and the underlying economic health of the country. Investors must navigate the sea of conflicting messages as they chart their courses through this unprecedented landscape.