The recent moves by interim leadership at the Consumer Financial Protection Bureau (CFPB) signal a pivotal moment for the agency that was established to protect consumers in the financial market. A memo issued by Adam Martinez, the Chief Operating Officer of the CFPB, outlined the agency’s transition to remote work due to the closure of its Washington D.C. office until mid-February. This decision directly follows an email from acting director Russell Vought, which instructed staff to curtail most of the CFPB’s regulatory activities. The swift changes come amid perplexing developments concerning the agency’s future, particularly after reports of personnel from Elon Musk’s DOGE organization gaining access to the CFPB’s internal datasets.

The CFPB was conceived in the wake of the 2008 financial crisis, with a mission to shield consumers from predatory practices by banks and other financial institutions. With approximately 1,700 employees, the agency has been instrumental in implementing regulations designed to uphold consumer rights. However, recent leadership changes and directives indicate a troubling transition that raises questions about its continued viability.

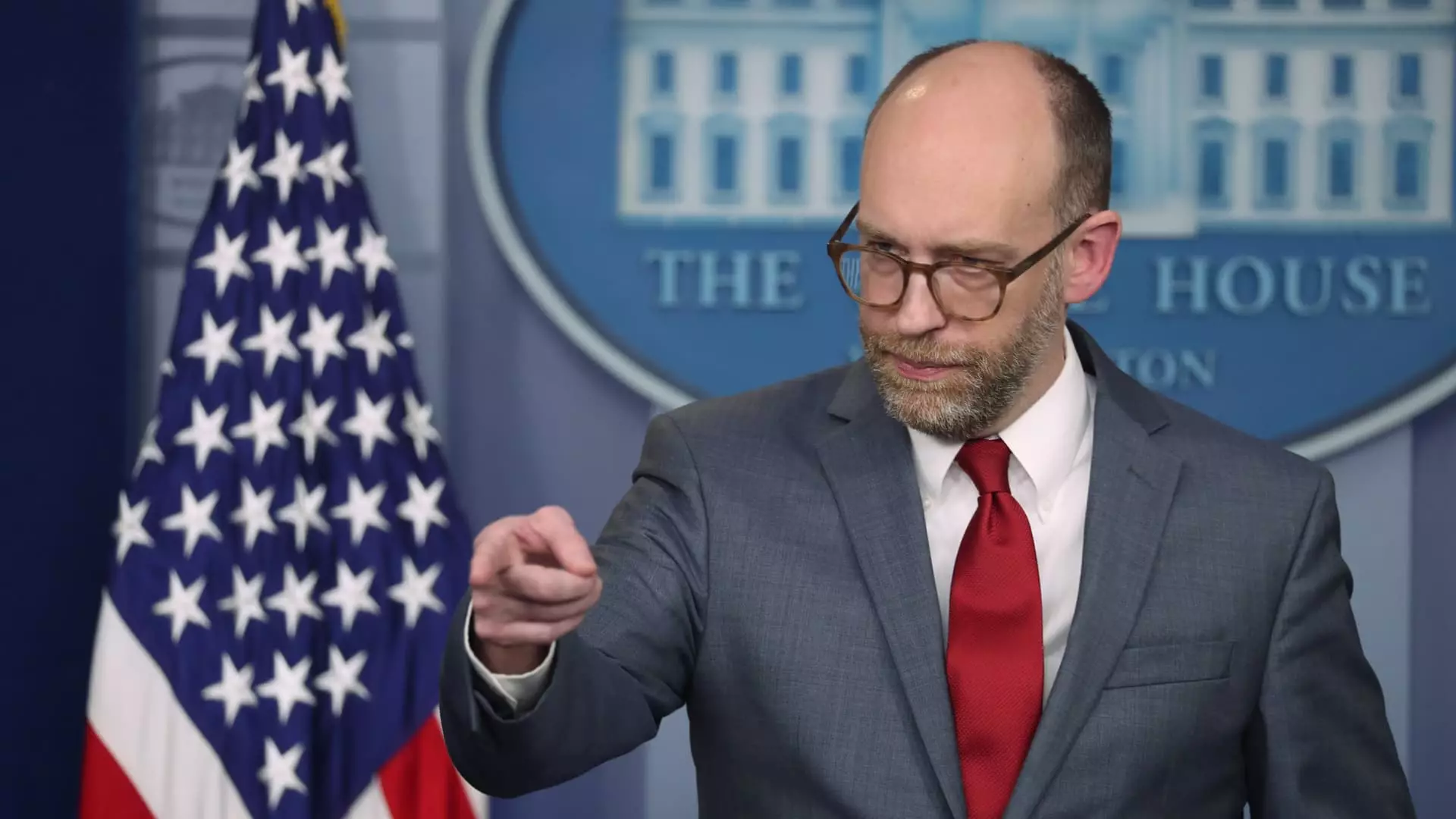

Russell Vought, who recently stepped into the role of acting director following his confirmation as head of the Office of Management and Budget, has wasted no time in altering the CFPB’s course. His email representing drastic cuts in the regulator’s operational capabilities, along with a freeze on new funding, suggests a future where consumer protections could be severely compromised. Such an approach contrasts sharply with the CFPB’s mission and poses significant risks to the protections established over the years for American consumers.

The role of external influences, particularly from figures like Elon Musk, adds an unnerving layer to the current situation. Musk’s public critique of the CFPB, alongside overt support for the DOGE organization, has amplified concerns around the agency’s very existence. Reports describing Musk’s operatives accessing performance reviews and other sensitive data prompt fears among employees and consumer advocacy groups alike. The potential for political whims to dictate the direction of consumer financial protection could unravel years of established safeguards.

Moreover, the move to remote operations and the crippling of most CFPB activities might soon jeopardize essential programs intended to protect the American public from unaffordable banking practices. Serious initiatives aimed at reducing exorbitant credit card and overdraft fees are currently at risk. With a potential reduction of workforce looming—sparked by Vought’s comments regarding the unaccountability of previous funding—it appears that not only the staff but also the consumers reliant on these protections face an uncertain future.

Banking trade groups have long contested CFPB regulations, branding them as overreaching. Their efforts to dismantle the agency’s authority culminated in attempts to declare it unconstitutional. These ongoing tensions manifest the struggle between consumer protection and industry-led profit motives. Amid this backdrop, the potential scaling back of CFPB’s regulations may embolden banks to pursue more aggressive profit-driven practices that often result in consumer detriment.

The ramifications stretch beyond administrative changes; they could translate into real economic pain for millions. For many consumers, the loss of protections established post-crisis translates into the potential resurgence of the kinds of financial abuses that led to economic downfall in the first place. A significant rollback of agency operations could strip consumers of billions of dollars, making financial stability unreachable for numerous American families.

The impending fate of the CFPB lies in the intersection between political volition and consumer rights. The agency currently faces an identity crisis, induced by disruptions at its helm. As professionals within CFPB brace themselves for the possibility of layoffs and significant operational reductions, it remains to be seen how these changes will impact consumer protection in practice. The ongoing situation is a stark reminder of how fragile regulatory institutions can be under shifting political tides. The stakes are high, and it calls for collective vigilance from consumers and advocates to ensure that their rights are not compromised in this uncertain landscape.